Insurance Software Development

Streamline your business processes with a custom insurance software solution that leverages data analytics and the Internet of Things while meeting the industry’s high standards for security and reliability.

We offer insurance software development services for:

Insurance companies

Insurance agencies

Independent software vendors

InsurTech startups

Stock companies

Agents and brokers

Insurance software development services at Altoros

As a software development company with insurance expertise, we build high-quality systems tailored to your needs. Deliver an excellent customer experience with online registration and claims management. Offer more competitive rates than ever before thanks to accurate risk assessment powered by big data analytics.

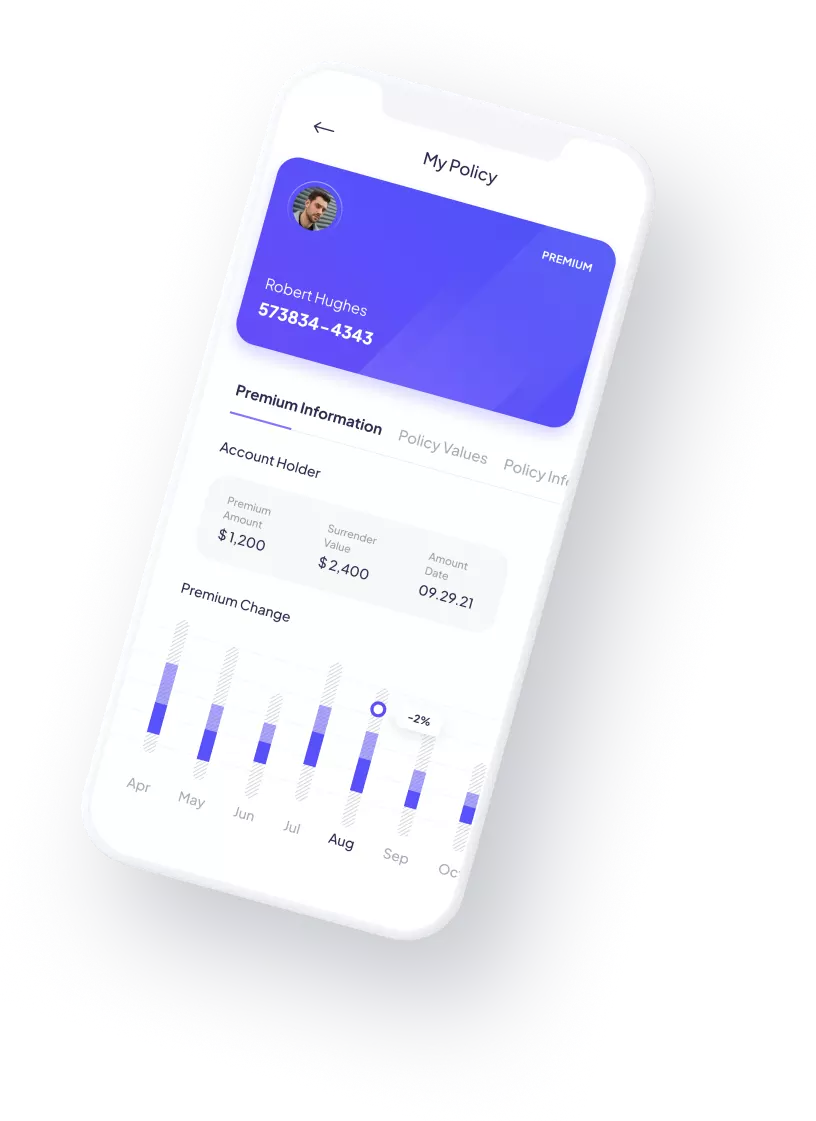

Hire the insurance software developers at Altoros to utilize modern methodologies and cross-platform technologies for building reliable and performant mobile applications that run on any operating system. We also design and implement web apps providing users with quick access to insurance services without the need to download or install anything.

Build a customer relations management (CRM) system tailored to your specific needs and business processes. As part of our insurance software development services, we can also upgrade an existing CRM system by adding new modules designed to facilitate lead generation, gather data from a variety of sources, and drive valuable insights.

We assist companies with insurance software development needs in adapting to industry changes and trends by implementing innovative features that improve customer experience. Our experts will analyze the architecture of your current solution and provide strategic recommendations to ensure stable performance and reliability.

Connect your system to a range of desktop and mobile apps, third-party services, and IoT devices, adding valuable data streams and enabling additional functionality. Partner with an experienced insurance app development company to build robust APIs and enable secure communication between software components.

As part of our development services for insurance companies, we help to improve risk assessment accuracy based on behavioral patterns and predictions. Offer more competitive rates and detect fraudulent claims with our cutting-edge solutions.

Partner with an established insurance app development company to enhance customer experience by upgrading legacy software with new features as well as convenient and intuitive user interfaces. Maintain security and reliability by keeping the underlying technologies updated and fixing any issues before they can affect the business.

We offer seamless data migration to a new platform

Compliance with industry standards and regulations

We help our customers to ensure their solutions meet international regulations and standards:

- ACORD (Association for Cooperative Operations Research and Development)

- ACA (Affordable Care Act)

- GDPR (General Data Protection Regulation)

- HIPAA (Health Insurance Portability and Accountability Act)

- PIPEDA (Personal Information Protection and Electronic Documents Act)

- CIA (Consumer Insurance Act)

- PRA (Prudential Regulation Authority)

- FIA (Financial Conduct Authority)

How insurance software development helps your business

Provide users with current information and relevant advice at any time with an AI-powered chatbot.

Data seamlessly collected by IoT sensors can assist insurers in building up detailed customer profiles and supporting policy decisions.

Data analytics helps to recognize trends in policyholders’ behavior, outline the main risk factors, as well as determine an appropriate price and coverage for each customer.

Facilitate customer service with personalized offers and intelligent recommendations. Support the decision-making process using complex machine learning algorithms to assess risks and prevent fraudulent claims.

Why choose Altoros for insurance software development

Frequently asked questions

What are the benefits of working with Altoros for insurance software development?

Our team has experience in developing custom software solutions for the insurance industry that address specific needs such as underwriting, claims processing, and policy administration. We leverage the latest technologies and development methodologies to deliver high-quality, scalable, and secure software. Our software development services can help insurance companies reduce operational costs, increase efficiency, and improve customer experience.

What tech stack do you use for insurance software development?

Our team of developers has experience with a variety of technologies and tools used in the insurance industry, including Java, .NET, Python, React, Angular, and more. We select the most appropriate technology stack for each project based on the specific needs of our clients.

How can Altoros help improve business operations for insurance companies?

We provide custom software development services that are tailored to the unique needs of each insurance company. By automating manual processes, streamlining workflows, and providing real-time data insights, our solutions can help insurance companies reduce costs, increase efficiency, and improve customer experience. We also help insurance companies stay compliant with industry regulations and data privacy laws.

How do you build a strategy for custom insurance software development?

To build a strategy for custom insurance software development, we tailor our approach to each insurance company's specific needs. Our general tips include defining needs, setting scope, timeline and tech stack, managing the project, refining outcomes and identifying areas of growth.

How much does it cost to build an insurance software?

The cost of insurance software depends on the project's required features and functionalities. We can provide you with an estimated budget based on your needs and requirements.

Related cases

Seeking a solution like this?

Contact us and get a quote within 24 hours